Analyzing Inflation’s Impact on Corporate Bond Yields: A Data-Driven Strategy (US)

Anúncios

Analyzing the impact of the current 3.4% inflation rate on corporate bond yields involves understanding how inflation erodes bond value, prompting investors to demand higher yields to compensate for the decreased purchasing power, crucial for informed investment strategies.

The interplay between inflation and corporate bond yields is a critical consideration for investors, especially in the current economic climate with a 3.4% inflation rate. This article delves into analyzing the impact of the current 3.4% inflation rate on corporate bond yields: a data-driven investment strategy, providing insights for navigating the complexities of fixed-income investments.

Understanding Inflation and Its Measurement

Inflation, the rate at which the general level of prices for goods and services is rising, significantly influences investment decisions. Understanding how it’s measured is the first step in analyzing its impact on corporate bond yields.

Common Inflation Measures

Inflation is typically measured using indices like the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI reflects changes in the prices of a basket of goods and services that are commonly purchased by households, while the PPI measures changes in the prices received by domestic producers for their output.

Anúncios

The Significance of a 3.4% Inflation Rate

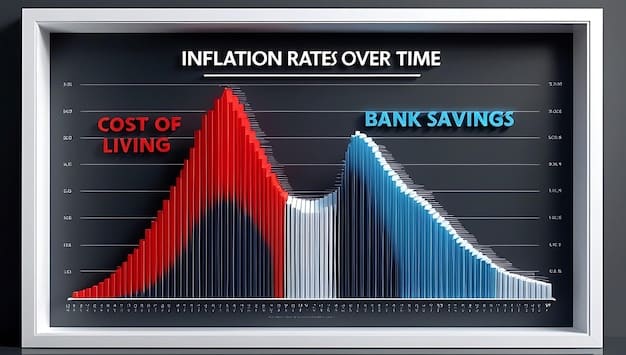

A 3.4% inflation rate suggests a moderate increase in the cost of living. While not considered hyperinflation, it’s high enough to influence monetary policy and investment behavior.

- Impact on Purchasing Power: Inflation erodes the purchasing power of money. A 3.4% inflation rate means that goods and services cost 3.4% more than they did a year ago.

- Central Bank Response: Central banks often respond to rising inflation by raising interest rates to cool down the economy.

- Investor Expectations: Investors adjust their expectations to account for inflation, demanding higher returns from investments to compensate for the loss of purchasing power.

Understanding these factors is crucial for analyzing how the current 3.4% inflation rate affects corporate bond yields, as investor demands tend to shift accordingly.

Corporate Bonds: An Overview

Corporate bonds are debt instruments issued by companies to raise capital. They offer investors a fixed income stream in the form of coupon payments, along with the return of the principal amount at maturity. Understanding how these bonds work is essential before diving into how inflation affects them.

Key Features of Corporate Bonds

Several key features define corporate bonds, including the coupon rate, maturity date, credit rating, and yield to maturity.

The coupon rate is the annual interest rate paid on the bond’s face value. The maturity date is the date when the principal amount is repaid. Credit rating, assigned by agencies like Moody’s and Standard & Poor’s, indicates the creditworthiness of the issuer. Yield to maturity (YTM) is the total return an investor can expect if the bond is held until it matures.

Types of Corporate Bonds

Corporate bonds can be classified into various types based on their credit rating and seniority. Investment-grade bonds are considered lower risk and are issued by companies with strong credit ratings. High-yield bonds, also known as junk bonds, are issued by companies with lower credit ratings and offer higher yields to compensate for the increased risk.

Senior bonds have a higher claim on the issuer’s assets in the event of bankruptcy compared to subordinated bonds.

Bonds are a financial tool that investors need to understand well.

- Investment Grade Bonds: Lower risk, issued by financially stable companies.

- High-Yield Bonds: Higher risk, issued by companies with lower credit ratings, offering higher returns.

- Senior Bonds: Higher claim on assets in case of bankruptcy.

Understanding the features and types of corporate bonds is crucial for assessing how inflation impacts their yields, requiring a thorough risk and return analysis.

The Direct Impact of Inflation on Bond Yields

Inflation has a direct and significant impact on bond yields. As inflation rises, the purchasing power of future bond payments decreases, prompting investors to demand higher yields to compensate for this erosion.

Inflation Expectations and Bond Pricing

Inflation expectations play a crucial role in bond pricing. When investors anticipate higher inflation, they demand higher nominal yields, which include both the real yield and the expected inflation rate according to the Fisher equation.

The Fisher Equation

The Fisher equation describes the relationship between real interest rates, nominal interest rates, and inflation. It states that the nominal interest rate is approximately equal to the real interest rate plus the expected inflation rate.

The formula is: Nominal Interest Rate = Real Interest Rate + Expected Inflation Rate. This equation underlines the bond yield’s adjustment to reflect inflation forecasts.

Historical Examples

Historical data shows a strong correlation between inflation rates and bond yields. During periods of high inflation, bond yields tend to rise, and vice versa. For example, in the 1970s, when inflation soared, bond yields also reached record highs.

The historical pattern clearly illustrates inflation-adjusted decision-making when investing in corporate bonds.

Data-Driven Strategies for Analyzing Corporate Bond Yields

A data-driven approach is essential for effectively analyzing the impact of inflation on corporate bond yields. Quantitative analysis and econometric models can provide valuable insights.

Quantitative Analysis Techniques

Regression analysis can be used to quantify the relationship between inflation and bond yields. By analyzing historical data, investors can estimate the sensitivity of bond yields to changes in inflation.

Econometric Models

Term structure models, such as the Vasicek and Cox-Ingersoll-Ross (CIR) models, can be used to model the relationship between bond yields of different maturities and macroeconomic variables, including inflation. These models help in understanding how inflation expectations are priced into the yield curve.

Such models facilitate more refined trading and management strategies.

- Regression Analysis: Quantifies the statistical relationship between inflation and bond yields.

- Term Structure Models: Helps model the yield curve and price in inflation expectations.

- Time Series Analysis: Useful for forecasting future bond yields based on inflation trends.

By employing these data-driven techniques, investors can gain a more accurate understanding of how inflation affects corporate bond yields and make more informed investment decisions.

Case Study: Impact of 3.4% Inflation on Specific Corporate Bonds

To illustrate the impact of the current 3.4% inflation rate, let’s consider a hypothetical case study involving specific corporate bonds. Assume that a company has issued bonds with a coupon rate of 4% and a maturity of 10 years.

Scenarios

In a scenario where inflation is expected to remain at 3.4%, investors would demand a higher yield to compensate for the inflation risk. The required yield might rise to 5% or higher, leading to a decrease in the bond’s price.

Data Analysis

By analyzing the bond’s cash flows and discounting them at the higher required yield, investors can determine the fair value of the bond. This analysis helps in understanding the extent to which inflation erodes the bond’s value.

This kind of analysis forms the basis for strategic investment shifts when inflation patterns change.

Real-World Examples

Examining companies with varying credit ratings can offer more insight. For example, a high-yield bond may see an even greater yield bump than an investment-grade bond, depending on how the market anticipates its resilience.

Mitigating Inflation Risk in Corporate Bond Investments

Several strategies can be employed to mitigate the risk of inflation in corporate bond investments, including using inflation-protected securities and adjusting portfolio duration.

Inflation-Protected Securities

Treasury Inflation-Protected Securities (TIPS) are designed to protect investors from inflation. The principal of TIPS increases with inflation and decreases with deflation, as measured by the CPI. Corporate issuers sometimes offer similar inflation-linked bonds.

Adjusting Portfolio Duration

Portfolio duration measures the sensitivity of a bond portfolio’s value to changes in interest rates. Shortening the duration of a bond portfolio can reduce its sensitivity to inflation, as shorter-term bonds are less affected by changes in inflation expectations.

Strategies include diversification for a more stable overall portfolio. Careful selection allows for inflation navigation.

- Treasury Inflation-Protected Securities (TIPS): Adjust their principal based on CPI changes.

- Shortening Duration: Reduces sensitivity to inflation expectations by focusing on shorter-term bonds.

- Diversification: Balances risk across different sectors.

Mitigation techniques protect a corporate bond portfolio against inflation’s negative impacts, vital for sustaining returns.

| Key Point | Brief Description |

|---|---|

| 💰 Inflation Impact | Erodes purchasing power and raises bond yields. |

| 📈 Fisher Equation | Nominal rate approximates real rate plus expected inflation. |

| 🛡️ Mitigation Strategies | Use TIPS, adjust portfolio duration, and diversify. |

| 📊 Data Analysis | Quantifies the statistical relationship between inflation and corporate bond yields. |

Frequently Asked Questions (FAQ)

▼

A 3.4% inflation rate erodes purchasing power, prompting investors to demand higher bond yields to compensate for the increased cost of goods and services. It also influences central bank monetary policy adjustments.

▼

Inflation reduces the real value of future bond payments, leading investors to seek higher nominal yields to maintain their real return. This increased demand drives up corporate bond yields.

▼

Data-driven strategies include regression analysis to quantify relationships, term structure models to understand yield curves, and time series analysis to forecast yields based on inflation trends.

▼

TIPS are securities designed to protect investors from inflation. Their principal adjusts based on changes in the Consumer Price Index (CPI), maintaining the real value of the investment despite inflation.

▼

Reducing portfolio duration by investing in shorter-term bonds minimizes sensitivity to inflation, as these bonds are less affected by long-term inflation expectations, providing some measure of protection.

Conclusion

Analyzing the impact of the current 3.4% inflation rate on corporate bond yields: a data-driven investment strategy requires a comprehensive understanding of inflation dynamics, bond characteristics, and quantitative analysis techniques. By employing these strategies, investors can better navigate the complexities of the fixed-income market and make informed decisions to protect and grow their investments in an inflationary environment.